COVID has made Financial Planning & Controlling Teams the hub of continuous planning that organizations must do to survive today. Here also comes a realization that finance teams must be comfortable with modeling and cannot be just proficient number crunchers.

And what kind of modeling skills do we need? It is not about budgeting, it’s mainly about Scenario Planning and Business Modeling we hear from CFOs these days. problem here is that while we, finance professionals, even before COVID did not have time in a week to analyze and model, now it is a strong expectation that Scenario Planning would become our Core Competence.

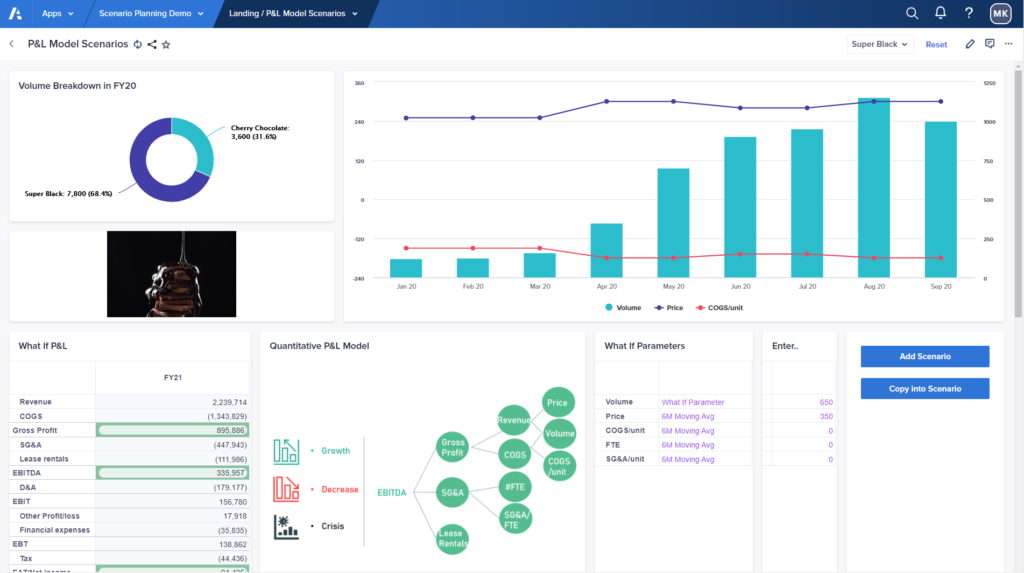

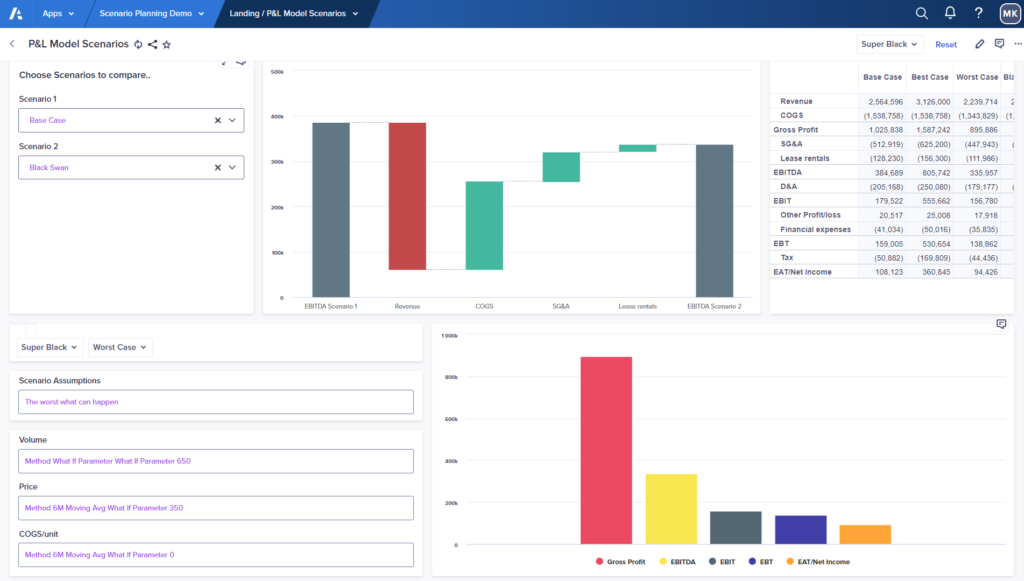

This post is to give you some inspiration on how your team could start up with scenario planning and show some examples how companies do it with Anaplan Connected Planning platform.

What does it take in 2020?

According to Numlix webinar survey, almost all Financial Planning & Controlling Jobs have been affected by COVID. Almost 70% of Financial professionals has indicated that more frequent and ad-hoc planning work has become a norm and they had to adopt different planning approaches.

Scenario Planning in 2020 is about “Unknown”. It becomes important to define what this “Unknown” is because that’s where Financial Planning & Controlling Teams could start exploring.

While exploring, Top Performers have been working on setting out multiple scenario plans, including worst cases. What performs the best are multidimensional scenarios, also in relation to the level of the organization (Global, Country, Local Scenarios). Another shift which has been made much quickly than expected is a switch to rolling 12- or 18-months forecasting process while giving less attention to Fiscal Year budgets.

Get comfortable with including external factors into Scenario Planning

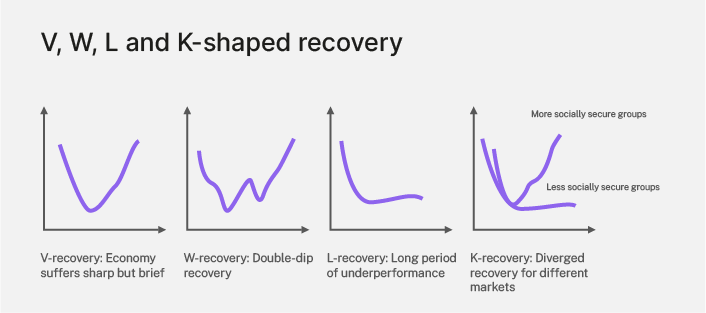

Indeed, Financial Planning & Controlling Teams need to look broader at the situation and take more external factors in analysis to build holistic macro-scenarios. One of the ways to approach it is to look at the macro-scenarios for economy using V, W, L or K-shaped curves.

V shaped recovery happens when economy growth quickly goes down and quickly comes back. Another scenario Financial Planning & Controlling Teams could investigate is W-shaped recovery. It is depicted as a double-dip type of recession but still encounters an opportunity to come back to the previous level of economic growth over time.

L-shared recovery is the most severe one and can be really called “recession”. The shape of L assumes that is a long period of underperformance and economy never comes back to previous growth levels.

As for K-shaped curve, it is used to reflect the situation when any kind of diverged recovery is taking place. For example, take different industries or different social groups and some of them have been going through V-shaped recovery while other groups are going through an L-shaped recession. This kind of analysis might also spot an opportunity!

By learning to take into account these kind of macro-level “uncertainties” Financial Planning & Controlling Teams can build what is called Alternative Futures scenarios: snapshots of the list of assumptions and strategic responses grouped around one or another shape of COVID recovery.

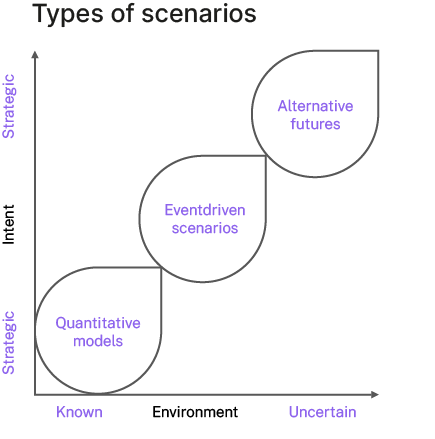

Know your options: Types of Scenario Planning

Alternative Future Type of Scenarios are proven to be effective for Strategic scenario planning in the situation of significant uncertainty. But for Tactical Scenarios the most common Scenario Planning type used by Financial Planning & Controlling Teams are Quantitative Models. These are Models with build-in fixed relationships between several variables. We this approach various Scenarios can be derived by playing “What Ifs” with a limited number of variables. Probably the most popular way of using this type of Scenario Planning is what can be called Scenario Versioning: calculating a Model for Base/Best/Worst Case Scenarios.

In general, Quantitative Models have been proven to be very helpful and rapid way of Tactical Scenario Planning. The problem with them though lies in the fact that they do not really challenge existing Model of doing business and operate strictly within this Model, potentially missing some opportunities.

What Financial Planning & Controlling Teams have also started adopting are Event Driven Scenarios. This type of Scenario Planning is built around An Event which is assumed to be quite probable to happen (that is why we plan for it). Event-Driven Scenarios do a good job if your Financial Planning & Controlling Team need to think about Tactical Response to a specific Event and Financial Impact of it. What this approach often does not consider is a potential overlap and important interdependences between several Events which do not happen in isolation.

Multidimensional Scenarios – make sure your Planning Tool is Ready

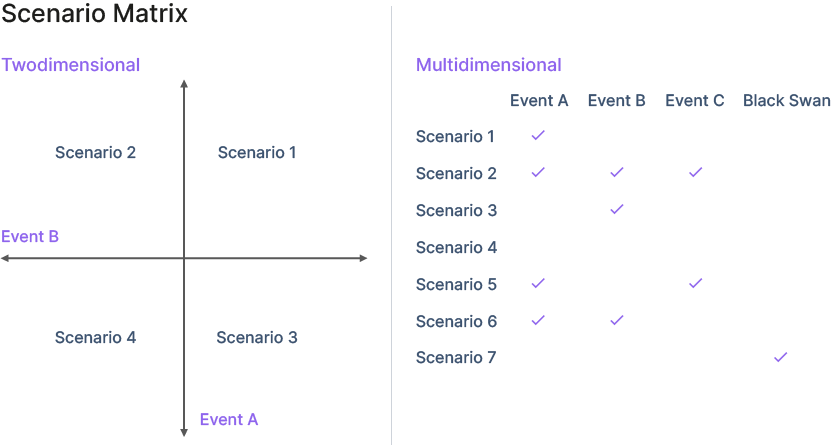

What can be a substantial enrichment to Event-Driven Scenario Planning is Multidimensionality. Let us look at what that is using an approach called Scenario Matrix.

Scenario Matrix is a tool conventionally used to map two events into four Scenarios, defined by four possible event combinations. It is a two-dimensional Scenario Matrix. But what if the ambition is to look at much more than two different, potentially interdependent events and build Scenario Planning around them?

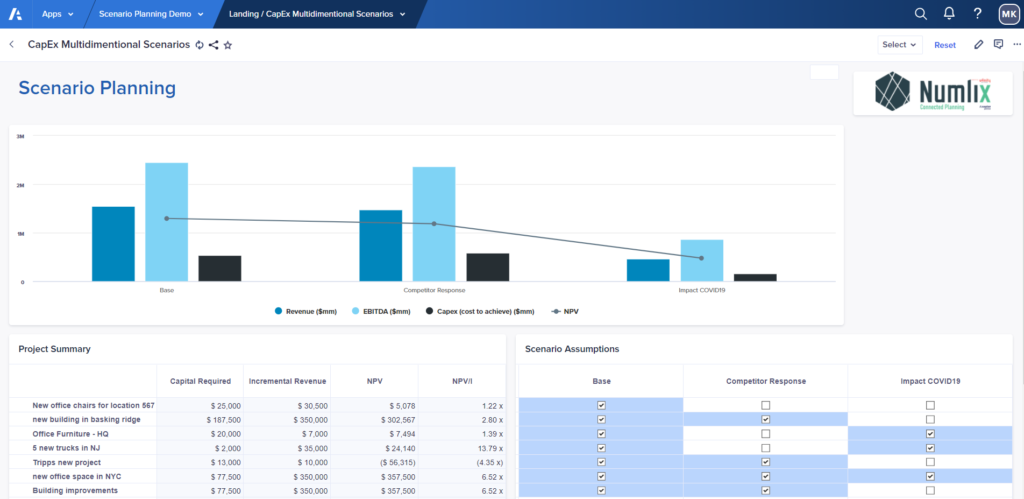

Multidimensional Scenarios have been attractive for Financial Planning & Controlling Teams but in practice they stayed for long impossible to implement because of an unbearable amount of “number crunching” if done in spreadsheets. Modern Cloud Financial Planning & Analysis Solutions allow this type of Scenario Planning much easier and in real-time.

Other Scenario Planning Challenges to overcome

Apart from Multidimensional Scenario Planning other challenges to overcome are usually about how to make Scenario Planning “stick” and incorporate it into company’s Planning routine. It is also connected to the fact that quite often Management Teams have to be educated by Financial Planning & Controlling on how to read and understand Scenarios and, what is more important, use Scenarios as an essential part of decision making process. The best way to go ahead is to make visual storytelling and interactive real-time Scenario Planning in the planning tool a part of monthly Management Team meeting. However not every planning tool supports this level of interactivity.

More Types of Scenario Planning to consider

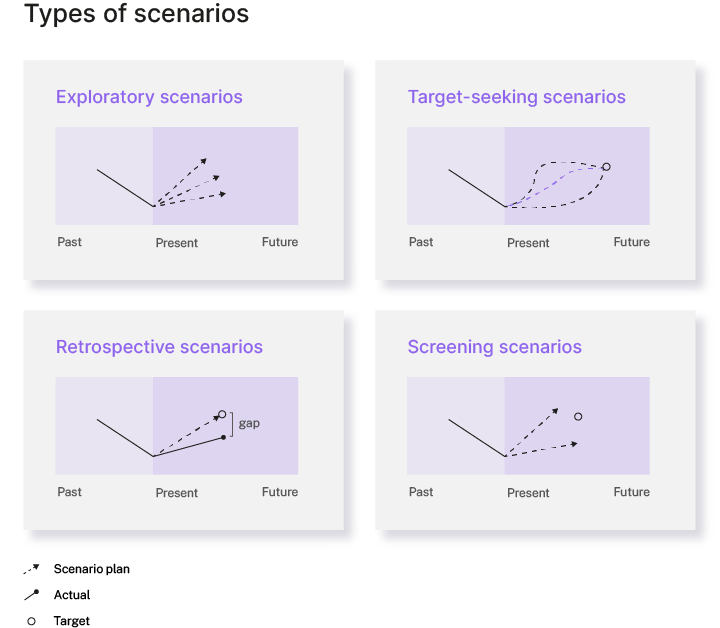

Another way of looking at Scenario Planning is focusing on how Financial Planning & Controlling Teams plan against some future Targets.

In the situation when there is no Target Scenario Planning has a purpose to explore to what could be out there. For Exploratory Scenario Planning it is important to approach assumptions as unconstraint by any knowledge of today. However quite often Scenarios are made to show a path to reach some defined Target in the future. If it is a Financial goal, then the role of Financial Planning & Controlling Team would be to look for alternative ways of reaching this target. In other words, if Plan A does not work Plan B maybe be the one to switch a company’s effort to.

Probably the most forgotten are Post-Scenario Planning types: while moving into the future Financial Planning & Controlling Teams better do regular Screening Scenarios Plans and Retrospective Scenario Planning. Retrospective Scenario Planning is designed to answer this question: “What could be our Plan to reach Target in the known circumstances of the past. Was it feasible to reach this Target?”

Even after moving out of COVID crisis, there is no doubt Scenario Planning is here to stay. Leadership demanding more visibility on the options based on more external data and multidimensional models. Interested in how to get your team ready? Watch our full Numlix webinar on how Financial Planning & Controlling Teams can bring Scenario Planning to the next level here.