80% of starters in Finance consider growing their coding skills …and more insights from the Numlix workshop at BYFT event:

Last week Thursday (December,9) Numlix brought young Finance professionals together to talk about the digitalization of FP&A.

Numlix Business & Solution Consultant, Marina Ketelslegers conducted a workshop on “How to catch your wave in the digitalization of FP&A” at “The Best Young Finance Team” event organized by CFO Magazine.

The workshop was meant to create awareness among young professionals on the most crucial areas of the digital change (also see survey results in a slideshow below):

Business Intelligence

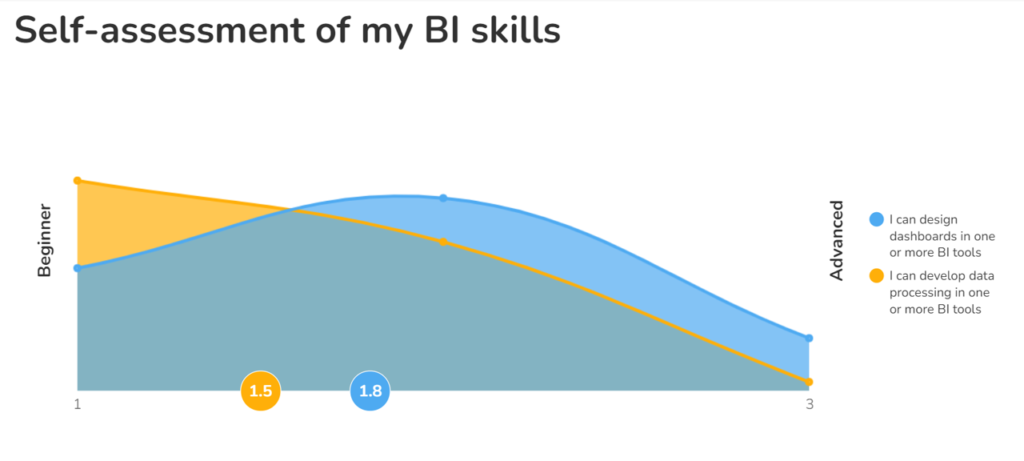

- Data Analysis and Visualization with BI tools has become an everyday reality for at least 70% of FP&A employees.

- Are they ready to take this on? Which tools are out there and in which one to chose to invest? Where to learn them?

- In the most of young professionals in Finance, based on their self-assessment, Data Visualization skills are closed to Advanced, while Data Analysis skills are Intermediate.

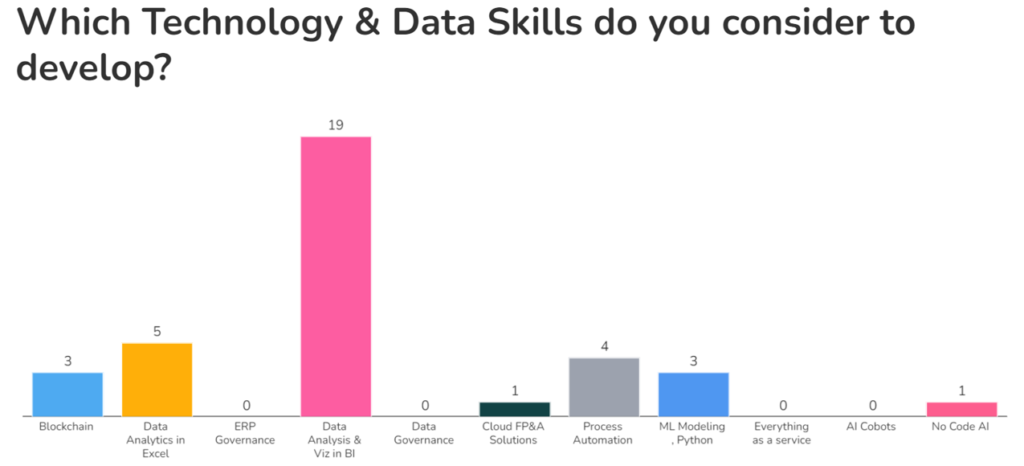

- Also half of them are considering to invest further in their BI skills.

Data Science & AI

- The pace of change of the skillset for Finance during the last 10 years was fast. No wonder that 94% of FP&A specialists are concerned about becoming obsolete in their profession.

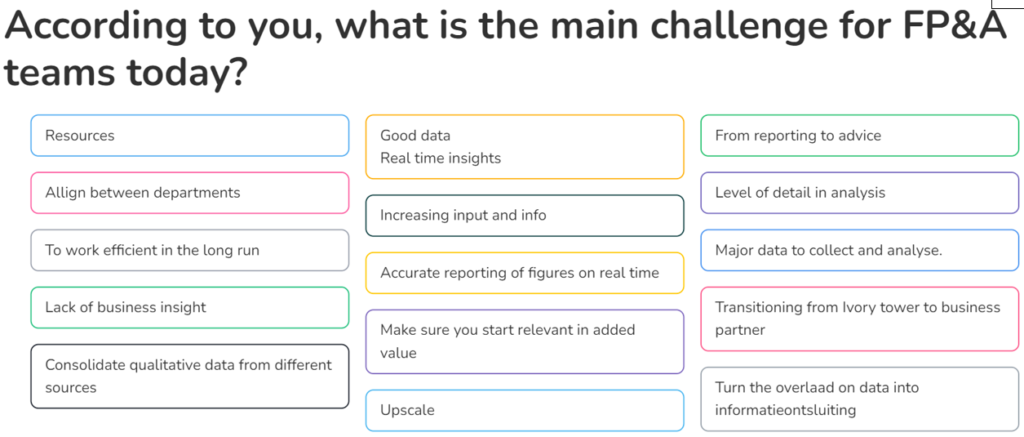

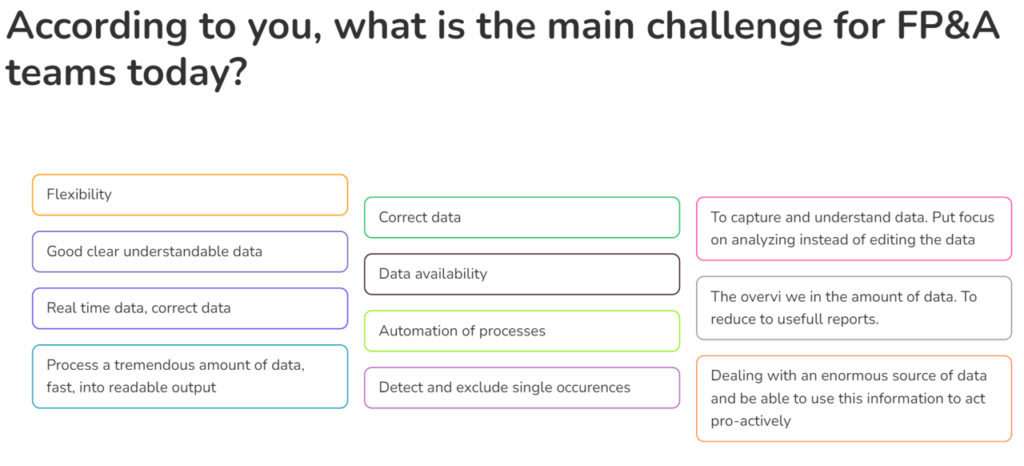

- Understanding data and managing it to get insights is THE challenge to solve for this new generation, according to young professionals themselves.

- 80% of the starters have shared that they realize the impact on the future skillset for Finance and are already actively growing their coding skills.

- The other challenge to take on is the change in communication.

- Being able to work remotely and still build High-performing teams is already a day-to-day task.

- Future holds for young professionals a rise of a new type of colleagues like AI enabled assistants, co-bots (collaborative robots) which are going to take over for routine tasks.

Rise of XP&A

- Last year Gartner has brought out an idea that FP&A is steadily evolving xP&A capabilities – Extended Planning & Analysis.

- This term states a trend that has been seen in Finance teams before – going from a pure Finance “function” to Business Partnering and now to Value creation via Data-based Insights.

- This value creation job of Finance involves more and more all other business teams into the planning process where Finance is placed centrally.

- The role of xP&A is in connecting those insights in real time, and often on one planning platform. That’s the way to increase quality and speed of business decision making.

- For young professionals it is still a new term but they are eager to learn more on it and participate in it.

So how to catch your wave in the digitalization of FP&A? Stay tuned for more news and events from Numlix team. And check out our next online session with Lineas.

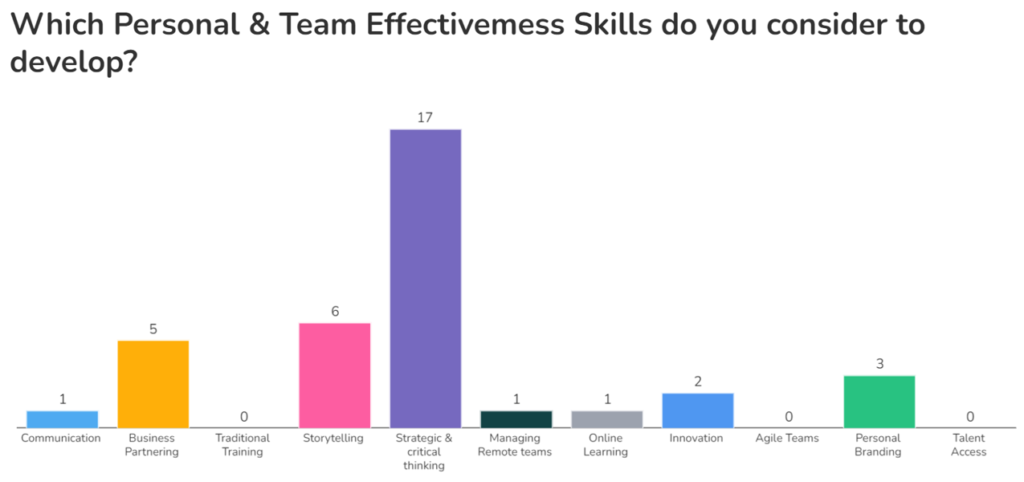

Survey results from the workshop: