Is your FP&A team able to modify its financial plans, budget, and forecasts when a major change in the business environment has taken place? Or is your entire finance team tied to a rigid budget based on outdated assumptions?

The past two years highlighted the importance of embracing the possibilities of digital transformation as well as cross-functional FP&A to enhance companywide collaboration to produce faster data for decision-making. 2022 brings another wave of uncertainty and to prepare companies for this, they must be able to adapt to industry changes, economic crises, and even global pandemics.

By integrating scenario planning for what-if analysis, finance teams can have a more hands-on approach to their FP&A strategy, which is crucial to respond to changes from moment to moment. We created a list of the FP&A trends for 2022, which will be interesting for CFO’s and finance professionals to watch in order to stay ahead of the competition when developing their business strategy:

5 trends in FP&A for 2022

1) Expansion of xP&A:

Finance automation is essential for an organization to shift the focus of its finance professionals from data aggregation and management to value-adding activities and forward-looking analytics which take an important role in shaping the business strategy.

Extended planning analysis, also identified as “xP&A” by Gartner, will reshape the current FP&A landscape by reducing the traditional silos between different departments. The breakdown of these silos will foster integrated business intelligence, which can transform how businesses use data to create business plans that have a further reach than their current financial plans.

xP&A gives business leaders the opportunity to take the forecasts and performance measurements from different functional departments and consolidate these into a coherent forecast. This will help them to understand the impact of decisions taken by one department on the others.

The adoption of xP&A encourages continuous planning, which leads to a plan that is continuously adapted to the latest conditions and events. A good xP&A tool will ensure that changes in one plan will automatically be synced with all the related plans, which will result in less manual work and a business plan that is always up to date.

At Anaplan, they call it Connected Planning, which enables companies to amplify their assets, potential and advantages. Large organizations are converting change to advantage as business resilience and agility becomes more important than ever before. With Anaplan, businesses are reducing risks and succeeding by continuously orchestrating business performance, systematically seeing possibility and seizing opportunity.

2) Adoption of Machine learning and AI:

In the past years, the potential of digital transformation in finance departments has become clear by the implementation of various ERP and CRM systems, which are now modernized and optimized so that businesses are ready to handle great amounts of data. Questions like “What are the next things that I should digitalize?” and “What role can machine learning and AI play in my data analysis?” are now dominating the discussion.

In large companies, finance departments usually make a bottom-up forecast every month, which is based on assumptions and spreadsheets from a handful of analysts. They have to clean, aggregate and align the data with the budget, which can lead to inaccuracies as human intervention is needed. Hence machine learning might offer a solution to recognize patterns in big sets of data which will help companies with the forecasting process.

This will be the first step towards a fully automated forecast where you can observe the effect of certain drivers on your forecast. The significance of different drivers can be tested through ML and AI algorithms which will improve the quality of your forecast as the algorithm is trained continuously. These algorithms can help to improve the strategic agility of your FP&A team as they can focus more on value-adding activities.

3) Further centralization of data:

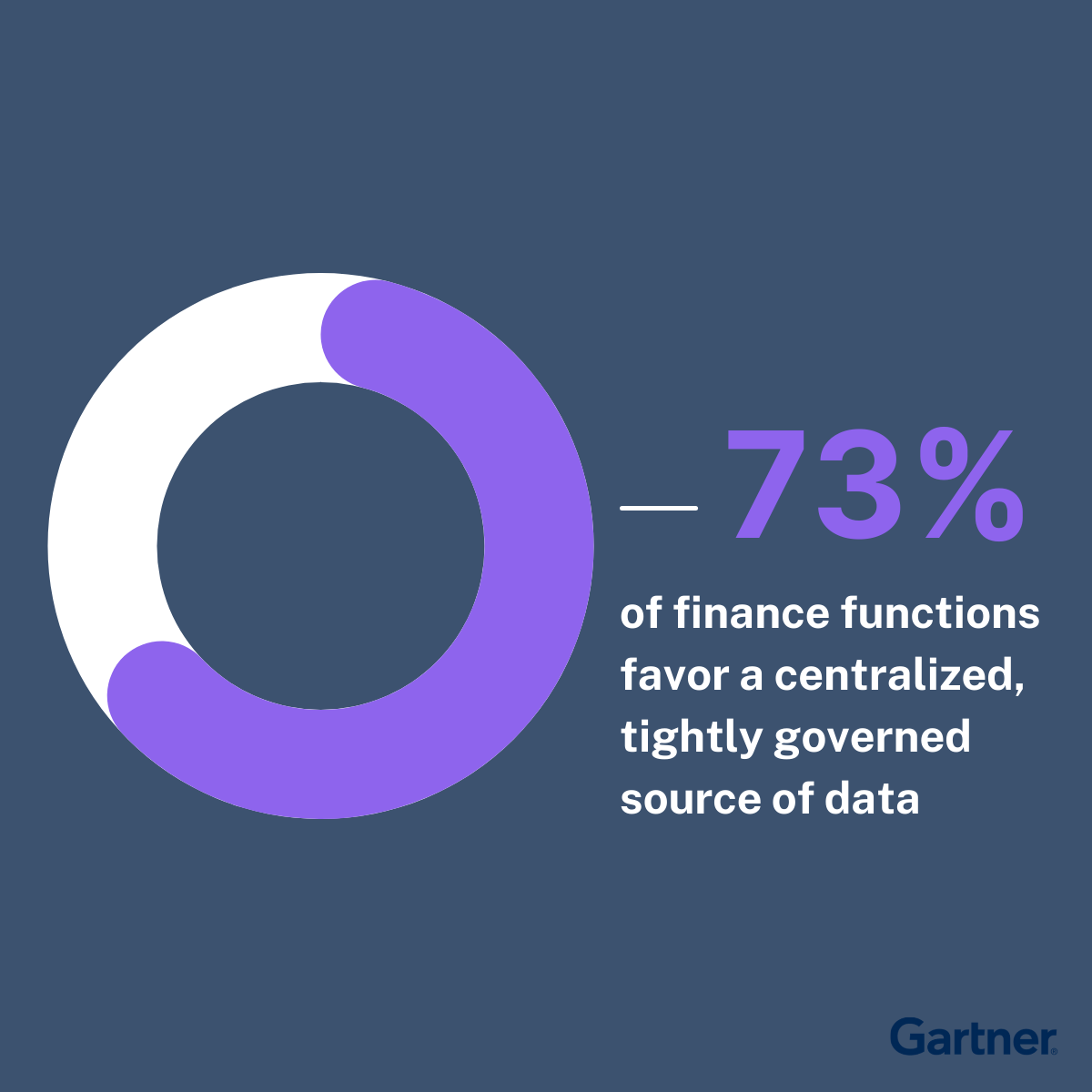

We have discussed that xP&A, machine learning and AI might be important trends to watch. After all, companies are eager to invest in advanced data analytics to produce precise forecasts in order to support their business decision-making process. However, business data is often dispersed over multiple systems and can be outdated, reports are not always standardized which can make it difficult for FP&A teams to provide clear, data-driven business insights that are essential to achieve growth.

Anaplan makes use of one model, called Data Hub, where data from source systems can be stored. This has as advantage that you have a single source of truth, where you can validate the data before you enter it into your FP&A model, resulting in more accurate output.

4) Finance professionals become storytellers:

Future-oriented CFOs no longer focus solely on sharing data and dashboards – they are, like journalists, a type of storyteller. They discover critical facts about their business, create a compelling story, and then communicate their strategic findings to colleagues and the board.

This is all made possible because FP&A software makes it easy to visualize critical data with intuitive graphs and charts that contrast and compare numbers over time and against forecasts. What would have taken hours to absorb, digest and interpret can now be seen in seconds. This makes it possible to immediately notice new trends in financial management.

Power BI is a tool where finance professionals can build modern graphs, charts, and other real-time visuals themselves. This has the large advantage that they are not limited to the pre-made dashboards from the developers. They can build their own visuals that support the story that they want to tell the stakeholders, which will convey a stronger message.

5) Increase cloud usage and leave Excel behind:

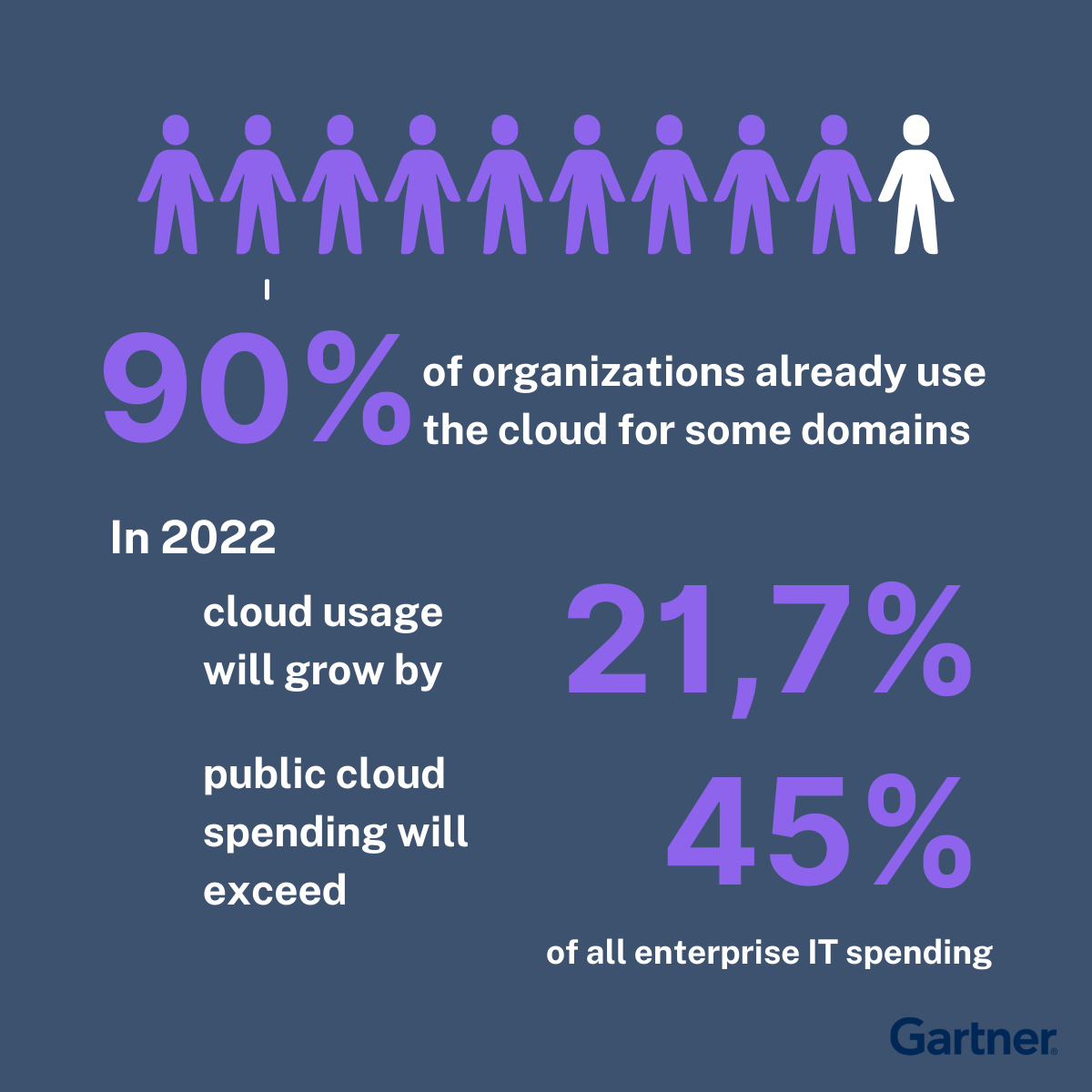

The cloud has proven itself in these times of uncertainty with its resilience, scalability, flexibility, and speed. 90% of organizations already use the cloud for some domains and expect to exceed their usage, leaving the organizations who do not embrace it behind with a strategic disadvantage. Gartner predicted that cloud usage will grow by 21,7% in 2022 and that public cloud spending will exceed 45% of all enterprise IT spending, coming from less than 17% in 2021.

Another advantage of cloud usage is that companies can phase out Excel in their FP&A processes. The spreadsheet program has the large disadvantage that computing power is limited, as everything is calculated locally. Further, you have the risk that multiple versions are used by different employees, as the changes made in the spreadsheet are often not uploaded to the cloud.

Anaplan is 100% cloud-based, which offers companies the flexibility and power for scenario planning and modeling. The heart of Anaplan is their hyperblock calculation engine which makes it possible to calculate changes almost immediately for incredibly large datasets. Something which is not possible when you have to rely on the calculation power of Excel on your own laptop.

Numlix, your new wave in finance

Companies realize more than ever that it is important to take their financial planning and forecast practices under the loop as the economic landscape is rapidly changing. With new technologies like machine learning and AI, FP&A teams are more able to give an idea about what the future might look like. This results in a transformation of the role of a finance professional from a number cruncher to a strategic partner for the organization.

If your FP&A team wants to stay ahead of game and follow the latest trends, Numlix is your partner to support your vision. With Anaplan, your financial forecasting, reporting, and budgeting can be simplified and placed into an intuitive and cloud-based interface. Because let’s face it, is it not a lost opportunity if you hire the brightest financials just to let them dig through excel sheets and do manual calculations?

Interested in learning more about how Numlix can streamline your entire financial planning process? Request a demo today!